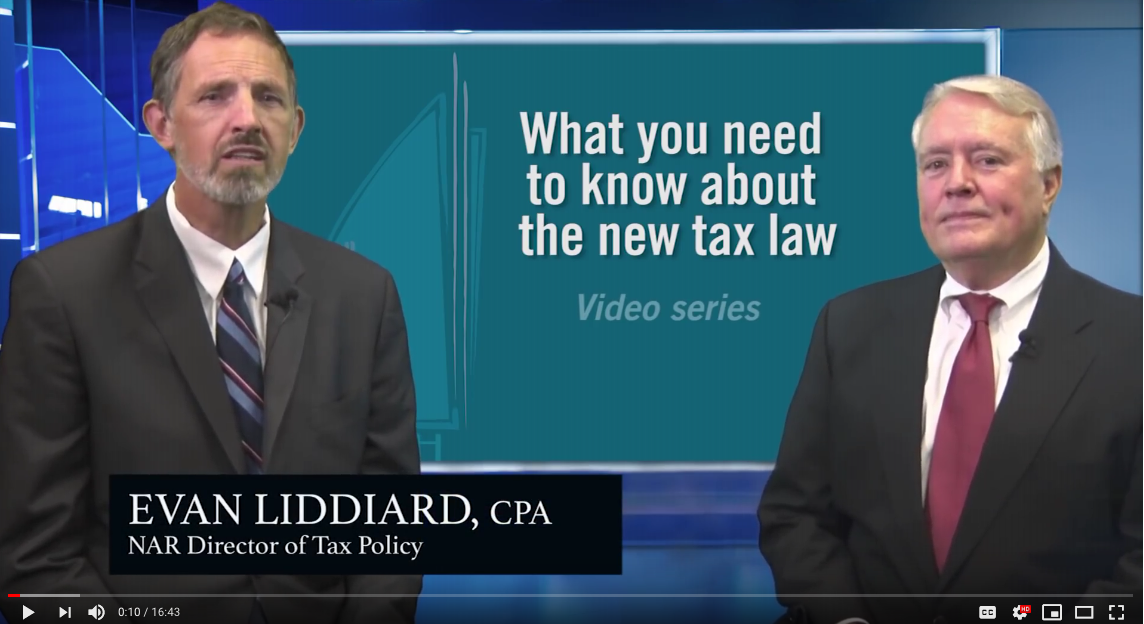

This video series with Evan Liddiard, Director of Federal Tax Policy for the National Association of REALTORS®, and Peter Baker of the Business Planning Group, gives an overview of 2018’s new tax laws. The series offers guidance for individuals and families filing tax returns, the tax incentives of owning a home, as well as business tax changes for real estate professionals.

Series 1: An Introduction to the Tax Cuts and Jobs Act of 2017

SEGMENTS

- Introduction to the series

- 3 driving forces of tax act

- What each video covers

Series 2: Major Changes Affecting Individuals

SEGMENTS

- Changes in tax rates

- Higher standard deduction

- Loss of personal exemptions

- Doubled child credit

Series 3: Changes Affecting Tax Incentives of Owning a Home

SEGMENTS

- Changes in MID

- Limits on state, local tax deductions

- Curtailment of casualty deduction

- Curtailment of moving expense deduction

- Retention of capital gains exclusion on home sale proceeds

Series 4: Tax Changes for the Real Estate Professional

SEGMENTS

- Elimination of business entertainment deduction

- Addition of 20% business income deduction